Mastering Your Money: 10 Proven Steps to Achieve Financial Freedom.

1. Understand the Basics of Budgeting

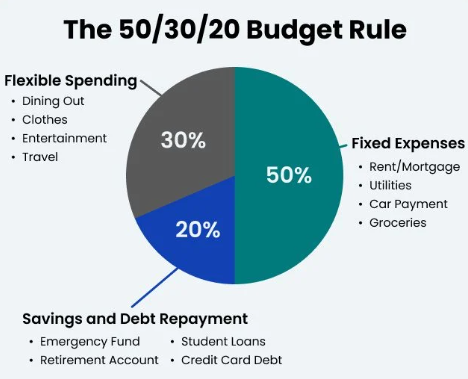

Budgeting is the starting point for financial success, providing a clear picture of your income and expenses. It allows you to plan where every dollar goes, ensuring you’re not overspending on non-essential items while neglecting your priorities. Mastering your money begins with understanding how to track and control your finances effectively. Use tools like budgeting apps or spreadsheets to make this process seamless, offering insights into spending habits and areas for improvement. The key to effective budgeting is consistency—review and adjust your budget monthly to reflect changes in income or expenses. For more tips, check out our guide to creating a budget that works.

2. Build an Emergency Fund

An emergency fund acts as a financial safety net, shielding you from unexpected expenses such as medical emergencies, car repairs, or sudden job loss. Ideally, aim to save three to six months’ worth of living expenses, but even starting with $1,000 can make a difference. Keep this money in a high-yield savings account for accessibility and to earn interest. Building an emergency fund requires discipline—set up automatic transfers to your savings account after every paycheck, treating it as a non-negotiable expense. Mastering your money also means preparing for the unexpected by having this critical cushion in place. Learn about how high-yield savings accounts can boost your savings.

3. Harness the Power of Compound Interest

Compound interest is a game-changer for building wealth, as it allows your investments to grow exponentially over time. The earlier you start, the more you benefit. For example, investing $5,000 annually at a 7% return from age 25 to 35 results in nearly $600,000 by retirement, even if you stop contributing after ten years. On the other hand, starting at 35 and investing the same amount until retirement yields significantly less. This highlights the importance of time in investing. Whether through stocks, mutual funds, or retirement accounts, let your money work for you by reinvesting earnings to maximize growth.

4. Differentiate Between Good and Bad Debt

Debt can either propel you forward or drag you down, depending on how it’s managed. Good debt, such as a student loan that increases earning potential or a mortgage that builds equity, can be a strategic tool. Conversely, bad debt, like high-interest credit cards or payday loans, often leads to financial stress. To manage debt effectively, prioritize paying off high-interest obligations first while making minimum payments on others. Consider the snowball or avalanche method to tackle debt systematically. Mastering your money involves understanding the role of debt and using it wisely to build a better financial future.

5. Prioritize Retirement Planning

Retirement may seem like a distant goal, but the earlier you start planning, the more you’ll benefit. Take advantage of employer-sponsored retirement plans like 401(k)s, especially if they offer matching contributions—it’s essentially free money. For those without access to such plans, consider individual retirement accounts (IRAs) or other investment vehicles. A key principle of retirement planning is diversification—don’t put all your savings in one type of investment. Regularly review and adjust your retirement plan to ensure it aligns with your goals and changing life circumstances. Remember, mastering your money now helps secure a stress-free retirement later.

6. Diversify Your Investments

A well-diversified investment portfolio reduces risk while increasing the potential for steady returns. Diversification involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds, to minimize the impact of market volatility. For example, if stocks underperform during a market downturn, bonds or other assets in your portfolio may stabilize your returns. Regularly rebalance your portfolio to maintain your desired asset allocation. This disciplined approach helps safeguard your investments against market fluctuations and ensures long-term financial growth, making it a cornerstone of any financial strategy.

7. Protect Yourself with Insurance

Insurance is a critical component of financial planning, offering protection against unexpected financial burdens. Health insurance safeguards you from costly medical bills, while life insurance provides for your loved ones in your absence. Home and auto insurance protect your physical assets, and disability insurance replaces lost income if you’re unable to work. Regularly review your policies to ensure they meet your current needs and adjust coverage as your circumstances change. While insurance may seem like an expense, it’s a necessary safeguard against potentially devastating financial losses, giving you peace of mind and stability.

8. Continuously Educate Yourself

Financial literacy is a lifelong journey that empowers you to make informed decisions. Many people overlook the importance of understanding financial concepts like interest rates, inflation, or diversification, which can lead to costly mistakes. Take advantage of free resources such as online courses, podcasts, and blogs to expand your knowledge. For example, learning about the stock market might open up new investment opportunities, while understanding credit scores can help you secure better loan terms. By continuously educating yourself, you stay ahead of financial trends, avoid common pitfalls, and position yourself for long-term success.

9. Set Financial Goals and Track Progress

Setting specific, measurable, achievable, relevant, and time-bound (SMART) financial goals provides a clear roadmap for your financial journey. Whether it’s saving for a home, paying off debt, or creating a college fund, writing down your goals increases the likelihood of achieving them. Break larger goals into smaller, manageable steps, and celebrate milestones along the way to stay motivated. Use apps or financial planning tools to track your progress and adjust your strategies as needed. Consistently reviewing your goals ensures you remain focused and adaptable, turning aspirations into tangible results.

10. Plan for Legacy and Estate Management

Estate planning ensures your assets are distributed according to your wishes, protecting your legacy and easing the burden on your loved ones. Start by drafting a will and naming beneficiaries for financial accounts. Consider setting up a trust to manage your assets, especially if you have significant wealth or specific instructions for distribution. Regularly update your estate plan to reflect major life changes such as marriage, children, or inheritance. By planning your estate proactively, you provide for your family, avoid legal disputes, and leave a lasting impact aligned with your values.

Pie chart showing the 50/30/20 budgeting rule for mastering your money