udgeting is the cornerstone of financial success, yet many people struggle to create and stick to a budget. A well-crafted budget not only helps you control your spending but also allows you to achieve your financial goals. In this guide, we’ll break down the steps to building a budget that works for your lifestyle and priorities.

Understand Your Income and Expenses

The first step in creating a budget is to get a clear picture of your financial situation. Start by calculating your total monthly income. This includes your salary, freelance earnings, rental income, or any other sources of revenue.

Next, track your expenses. Divide them into three categories:

- Fixed Expenses: Rent, utilities, insurance premiums, and loan payments.

- Variable Expenses: Groceries, gas, and other costs that fluctuate monthly.

- Discretionary Spending: Non-essential expenses like dining out, entertainment, or shopping.

Use tools like budgeting apps, spreadsheets, or even pen and paper to record your income and expenses. This process will reveal where your money is going and identify areas where you might overspend.

Set Financial Goals

A budget should reflect your financial goals, whether they’re short-term or long-term. Here are some examples:

- Short-term goals: Building an emergency fund, paying off a credit card, or saving for a vacation.

- Long-term goals: Saving for retirement, buying a home, or funding a college education.

Assign a dollar amount and a timeline to each goal. For instance, if you want to save $1,200 for a vacation in six months, you’ll need to set aside $200 per month. Defining your goals gives your budget a purpose and keeps you motivated.

Choose a Budgeting Method

There are various budgeting methods, so choose one that aligns with your preferences and financial situation. Here are some popular options:

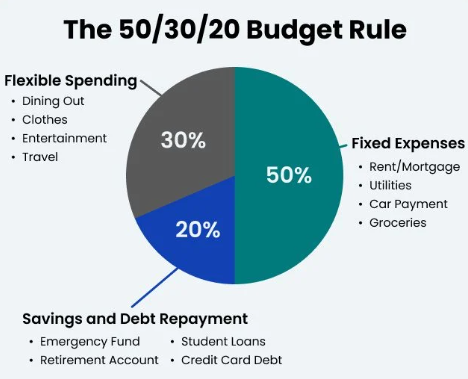

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar of your income to a specific purpose, ensuring that your income minus expenses equals zero.

- Envelope System: Use cash for specific categories like groceries or entertainment, and stop spending when the envelope is empty.

Experiment with these methods to find what works best for you. You can also mix and match elements of different methods to create a customized budget.

Automate and Track Your Progress

One of the easiest ways to stick to your budget is by automating your finances. Set up automatic transfers for savings, debt repayment, or bill payments. This ensures you prioritize important goals before spending on discretionary items.

Regularly review your budget to track your progress. Use apps like Mint, YNAB (You Need A Budget), or personal finance spreadsheets to monitor your spending. Make adjustments as needed, especially when your income or expenses change.

Stay Flexible and Avoid Perfection

A budget is a living document, not a rigid set of rules. Life is unpredictable, and unexpected expenses can arise. Allow room for flexibility and adapt your budget to accommodate changes. For example, if you spend more on groceries one month, compensate by reducing dining-out expenses.

Also, don’t be discouraged by occasional slip-ups. The goal is progress, not perfection. Celebrate small wins, like saving an extra $50 or reducing unnecessary expenses, to keep yourself motivated.

Conclusion

Creating a budget that works is about understanding your financial situation, setting realistic goals, and staying consistent. By following this guide, you can take control of your finances, reduce stress, and build a secure financial future.